Selling the family silver: Birmingham’s Café Block disposal and the failure of scrutiny

Birmingham City Council has agreed to sell the freehold of the “Café Block” in the Jewellery Quarter, 36 to 41 Vyse Street and 2, 4 and 6 Hylton Street.

On the surface, the report to Cabinet looks routine: a disposal of smaller, management-heavy assets, marketed by Lambert Smith Hampton, with “competitive bids” and commissioners raising “no observations.”

Look closer and the flaws are obvious. The paper reads less like an options appraisal and more like a justification for a decision already taken.

What the report says

The case presented is simple:

- Selling the Café Block will generate a capital receipt to support the Financial Recovery Plan.

- The council avoids future liabilities, especially energy efficiency upgrades, since the units carry EPC E ratings.

- Management headaches, including complex sub-lettings, pass to a private owner.

- There will be a loss of rental income, said to be offset by savings on maintenance.

That is the entirety of the financial logic.

What the report leaves out

Nowhere does the report test the obvious counterfactual: keep the asset, invest sensibly, and bank the rent roll for 10 or 15 years. Even modest assumptions produce large numbers.

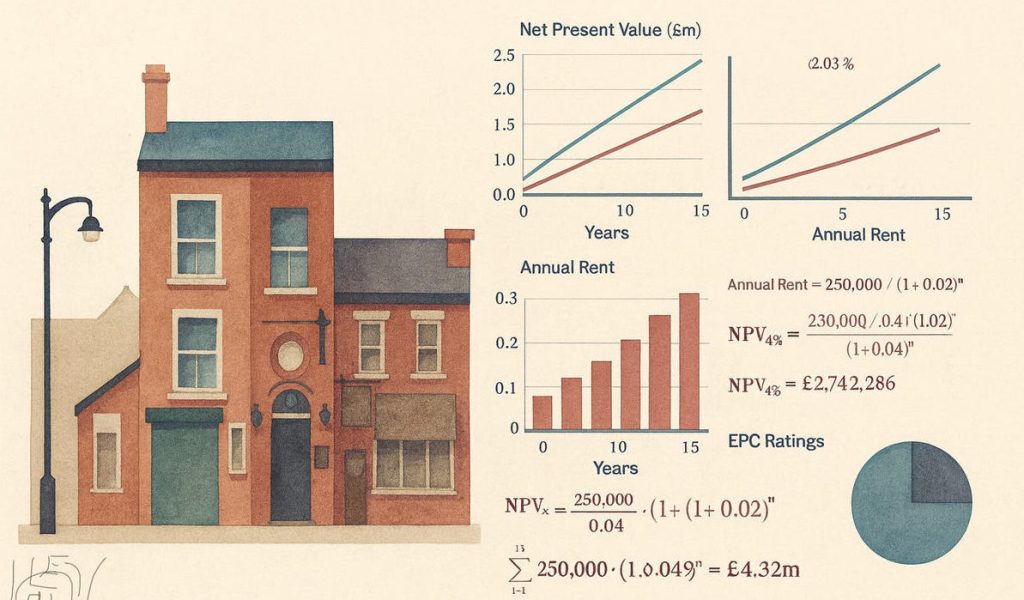

With £250,000 annual rent rising by 2% a year, the 10-year total is about £2.74m and the 15-year total about £4.32m. On a discounted basis at 4 to 6%, the net present value ranges from about £2.21m to £2.00m over 10 years, and about £3.16m to £2.74m over 15.

These are illustrative numbers, but they show the scale that should have been in front of Cabinet. Yet the paper gave members (councillors) nothing. The sale price is hidden in exempt appendices. The current rent roll is not quantified. Options are not compared. Members were asked to approve disposal without the information needed for a balanced judgment.

Weak reports, weak oversight

This case is not only about the Café Block. It is about the quality of officer reporting, the standards Cabinet members are prepared to accept, and the role of commissioners who are supposed to enforce discipline.

A competent report would have set out the rent roll, the costs, the investment options, the sensitivity tests, and the long-term value of retention. It did not. Officers served up a wafer-thin narrative and called it an appraisal.

But Cabinet members are not passengers. They had the power to say: “This paper is not good enough. Take it back and do the work properly.”

They chose not to. Weak reports only flourish when weak Cabinets wave them through.

And what of the commissioners. They nodded it through with “no observations”. These are the government’s own watchdogs, placed in Birmingham to enforce rigour. If they are content to see assets disposed of without the most basic financial facts in view, what exactly is their purpose.

The missing rent roll: the dog that didn’t bark

The most glaring omission is the rent roll. That single number tells you what the Council earns today and what it stands to lose tomorrow. Yet it is nowhere to be found in the Cabinet report. Not a line, not even a hint.

This is not a minor oversight. It is like selling a business without mentioning its turnover. How can members possibly judge whether disposal is better value than retention when they are denied the most basic financial fact.

And let us be clear: these are not empty shells. They are occupied workshops and shop units in the heart of the Jewellery Quarter, all paying rent. The Council knows exactly what it takes in each year. Officers chose not to share it. That is not professional judgment. That is gatekeeping of information that Cabinet should have had in black and white before being asked to wave through a sale.

I have chaired scrutiny. I know what a competent report looks like. This one fails the test at the first hurdle. The rent roll is the dog that did not bark, and the silence tells its own story.

Weak areas that deserve challenge

Several other shortcomings leap off the page:

- Capital receipt concealed. The central figure is hidden. How can members or the public judge best value if the number is secret, even in range terms.

- Commissioners’ silence. “No observations” reads like a box-tick, not rigorous oversight. Why was the missing analysis not required.

- Ward councillors sidelined. They were informed, not consulted. There is no record of their views. Of course they may not have one!

- Appears also the respected and renowned Jewellery Quarter BID also not consulted.

- Tenants brushed aside. Rights may transfer, but what of rent rises, unauthorised sub-lets, redevelopment risk, break clauses and security of tenure. None of this is tested.

- Heritage not weighed. The paper nods to the Jewellery Quarter Neighbourhood Plan, but there is no serious assessment of whether a private sale strengthens or undermines it.

A failure of officer standards

As someone who chaired the main Birmingham scrutiny committee for years, I can say this paper would not have passed muster. Scrutiny should have demanded long-term projections, open figures wherever possible, and a clear comparison of options with sensitivities. Officers have a duty to present a rounded picture, not a single narrative for disposal. This style of reporting lets members down and undermines public trust.

What happens next

Local Conservatives have called the decision in for scrutiny. Cllr Ken Wood, Deputy Lord Mayor, is leading the call-in, seconded by Cllr Alex Yip, Shadow Cabinet Member for Social Justice, Communities, Safety and Equalities. I respect both men and know they are capable of rigorous, forensic scrutiny. I hope they use that platform to ask the blunt questions Cabinet ducked: what is the rent roll, what are the options, what is the real value of holding versus selling, and why was all of this airbrushed out of the paper.

A bigger question for Birmingham

Strip away the officer spin and this is what we are left with: a Cabinet decision taken without the most basic financial facts on the table. No rent roll. No comparison of options. No transparent receipt. That is not stewardship, it is abdication.

If the logic here holds, then nothing is safe. The Council House itself could be put on the block: high maintenance, poor EPC, management costs. Would anyone seriously argue for flogging off the city’s civic heart to plug a hole in the budget. Of course not. Yet that is exactly the logic being applied to the heritage fabric of the Jewellery Quarter.

This case is not just about officers, it is about standards right across the board. Officers wrote it. Cabinet waved it through. Commissioners nodded approval. Weak reporting plus weak decision-making equals bad governance. And Birmingham, after everything this city has been through, cannot afford bad governance.

The city deserves better

This is about more than one block of workshops. It is about whether Birmingham treats its heritage and its businesses as assets to nurture, or as chips to cash in. The city deserves better. The Jewellery Quarter deserves better. And Birmingham deserves higher standards from its officers, its Cabinet, and its commissioners than this sorry exercise in box-ticking.

1 Comment