British retail sales rose by 1.2% in April – exceeding expectations by 1%.

The uptick in consumer activity was attributed to the sunniest April since records began.

Data from the Office of National Statistics (ONS) shows food sales grew nearly 4%.

Consumer demand

This is a far cry from the warnings of “awful April” following the increase in utility bills and other cost of living headwinds, not least uncertainty over US trade tariffs.

The GfK consumer confidence index, which measures how people view their own financial situation and wider economic prospects, rose by 3% in May.

There seems to be a willingness to spend which is reassuring to economists as household consumption is 60% of GDP.

Looking ahead

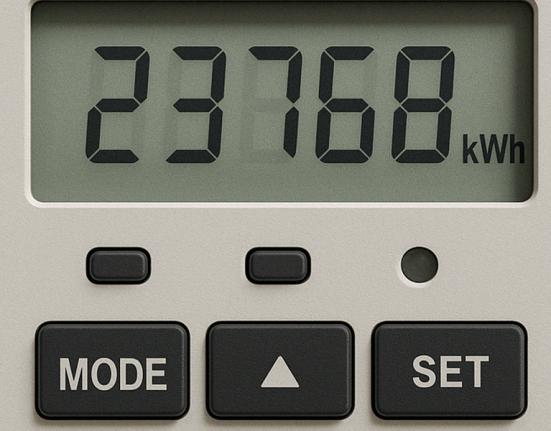

A reduction in energy bills is due in July. The Bank of England cut its interest rate, and the UK has signed trade deals with the US, India and Australia.

The British Retail Consortium said more people expected the economy to improve in May than they did in April.

The UK’s Consumer Prices Index (CPI) inflation rate rose to 3.5% in April, up from 2.6% in March.

CPI including owner occupiers’ housing costs (CPIH) increased to 4.1% in the 12 months to April, up from 3.4% in March. Core CPIH, which excludes volatile items like energy and food, also rose to 4.5%

Looking ahead, the Bank of England forecasts that inflation will remain above 3% throughout 2025, potentially peaking at 3.7% by September, before gradually returning to the 2% target in early 2027.